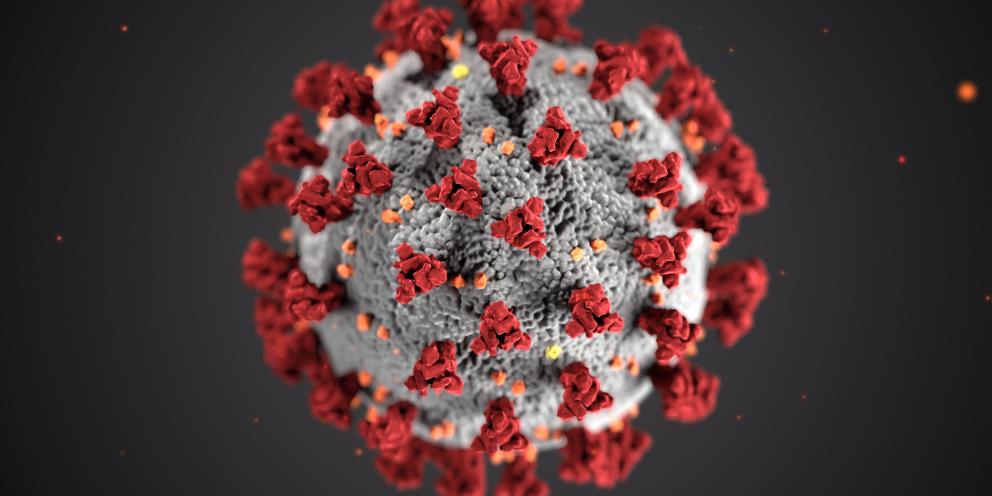

Ever since coronavirus was labelled a global pandemic, it has unfortunately spread very fast around the world, but not just through people- through economies as well. A country’s currency is directly or indirectly linked to its economy, so as economies are beginning to falter, so are their respective currencies.

GBPEUR exchange rates opened this year at a great level of 1.20– following Boris Johnson’s landslide victory in December- providing a heap of certainty towards the UK successfully leaving the EU due to his majority in Parliament. Unfortunately, as the year has progressed, Covid-19 has spread all over the world- causing lockdowns in the USA, Europe, the UK, and pretty much everywhere else. Though these lockdowns are being done for correct reasons, and hopefully successfully slowing the spread of the virus- it is, unfortunately, crippling economies as each day passes by.

Central banks have all cut interest rates- and begun printing more money than ever before to try and keep liquidity open in the markets to prevent crashes, the UK and US Governments have also added wartime fiscal measures to try and prevent loss of employment and businesses from going under through this period- but with all that said, it still may not be enough.

As mentioned previously, GBPEUR opened this year at 1.20– as Covid19 ripped its way through the UK, we have seen the exchange rate as low as 1.08 (A 10% drop), before now stabilising around the 1.14 area. To put this in context, a purchase of €500,000 is now costing an extra £22,500 compared to January!

Many analysts are now predicting a global recession following this pandemic, and as each day goes by, this prediction becomes more likely to happen.

With all countries doing lockdowns, we hope that it will follow the same path as Wuhan in China, which is now open and resuming normality- which hopefully we will see soon for us. In the meantime, it is worth noting that Sterling has begun to bounce back from the lows of 1.08- and anything about 1.13 is a positive area for buyers. (And of course, these low levels are still fantastic for Euro sellers.). After this is done, the UK still has the issue of a trade deal with the EU, if this isn’t done by December, we can expect the Pound to weaken further.

It’s a long road ahead, filled with volatility, but for those of you who may have Euros to buy in the future, opportunities always arise. If you would like further clarity please don’t hesitate to contact us at info@currencies4you.com and above all, please stay safe and look after yourselves through these testing times.